Top 5 Warehouse Management Mistakes Brands Make When Scaling eCommerce Operations

As Henry Ford wisely said, “The only real mistake is the one from which we…

Over the past decade, digital commerce has scaled faster than any other business function. Global eCommerce has grown at more than 15% CAGR, outpacing overall retail growth by nearly 3X, while India’s digital commerce market alone is expected to cross USD 345 billion by 2030. Brands responded by investing aggressively in traffic acquisition, expanding marketplace presence, launching apps, and building omnichannel capabilities at speed. As a result, discovery is no longer the bottleneck – access has been solved.

However, as 2025 draws to a close, a structural reality has become increasingly clear across boardrooms in India and the GCC: growth driven purely by clicks is reaching diminishing returns. According to McKinsey, more than 40% of marketing spend today yields suboptimal ROI, primarily due to fragmented data, ineffective conversion execution, and disconnected customer journeys. Traffic continues to rise, but conversion rates, margins, and lifetime value are under pressure.

Commerce is no longer constrained by reach. Today’s consumers are always online, deeply informed, and relentlessly comparison-driven. Over 80% of shoppers research products digitally before making a purchase, even when the final transaction occurs offline. The competitive advantage has shifted from acquisition to conversion, continuity, and compounding value over time. This marks a fundamental transition – from transaction-led commerce to conversation-led commerce.

What we define as Commerce 4.0 is not a trend or a technology wave. It is a systemic response to the structural inefficiencies that now limit scale: fragmented stacks, channel-led decision-making, reactive CX, and growth strategies divorced from profitability. In an always-on, AI-enabled environment, winning brands are those that can orchestrate intent, experience, operations, and economics as a single growth system – turning every interaction into an intelligent, value-creating conversation.

Commerce 3.0 marked a significant evolution in how brands approached growth. The focus shifted from pure transactions to experience – apps replaced websites, omnichannel journeys blurred online and offline, personalization became table stakes, and speed turned into a competitive weapon. On the surface, this era delivered visible progress: better interfaces, richer content, faster checkouts, and more touchpoints across the customer journey. However, beneath this layer of experience, structural complexity quietly accumulated.

Most brands scaled Commerce 3.0 by adding layers – new tools, new channels, new agencies, new dashboards – without re-architecting how decisions were made. As a result, growth became fragmented rather than compounded. Traffic continued to rise, driven by paid media, marketplaces, and social platforms, yet conversion rates got stagnated. Investments increased, but outcomes failed to scale proportionately.

At an operating level, tech stacks expanded rapidly – CRM, CDP, OMS, analytics, experimentation, loyalty but insights remained siloed. Data existed everywhere, intelligence existed nowhere. Customer experience was increasingly “designed” through UI and journeys, but rarely intelligent – unable to adapt in real time to intent, context, or profitability signals.

Growth teams, incentivised by channel-level KPIs, optimised individual levers – media ROAS, app installs, campaign CTRs – rather than the system as a whole. The result was local optimisation with global inefficiency. In many cases, brands scaled volume while quietly eroding margins, sacrificing profitability in pursuit of topline growth.

This breakdown is not anecdotal – it is structural. According to McKinsey, organisations that fail to integrate data, experience, and execution across channels lose 30–40% of potential value due to poor decision-making, duplicated efforts, and fragmented operations.

Commerce 4.0 does not emerge from innovation alone. It emerges from necessity. In an environment where scale without intelligence amplifies inefficiency, complexity becomes a liability rather than an advantage. The next phase of commerce demands a shift from layered execution to orchestrated growth systems – where experience, data, operations, and economics work together in real time.

In short, most retail brands today still face the same set of issues:

Let’s dive deep to understand the concept.

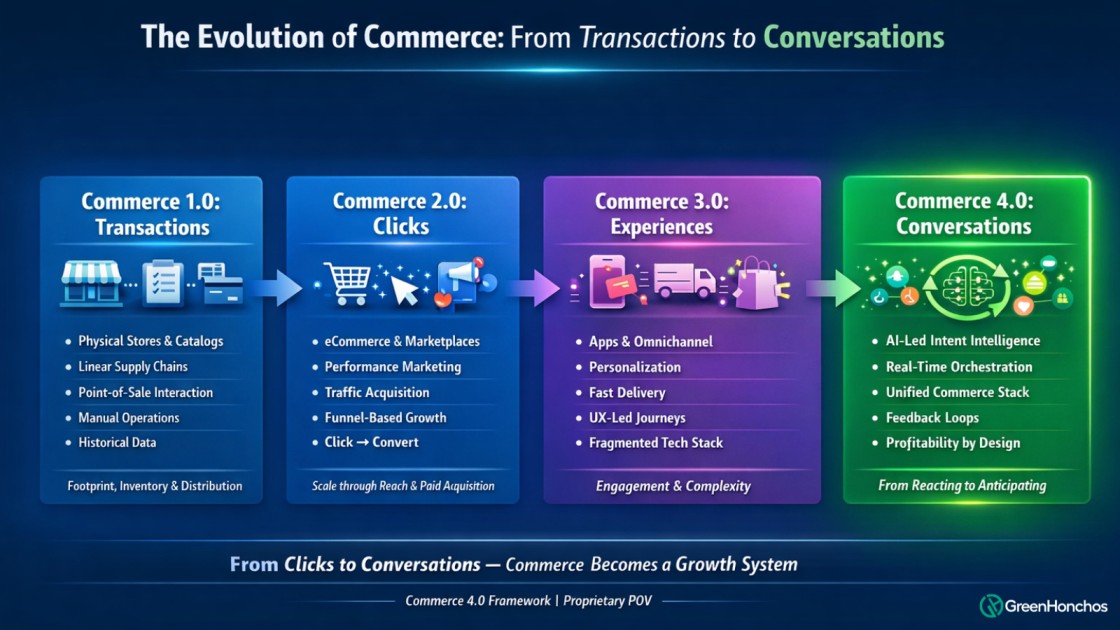

The evolution of commerce has not been driven by technology alone – it has been driven by how brands interact with consumers at scale. Each phase of commerce fundamentally redefined operating models, decision-making, and the role of data.

Commerce began as a linear, location-bound model. Physical stores, catalogs, and manual supply chains defined how brands operated. Customer interaction was episodic and transactional – limited to the point of sale. Data, where it existed, was historical and lagging. Growth depended on footprint expansion, inventory availability, and distribution efficiency rather than insight.

The rise of eCommerce, marketplaces, and performance marketing introduced scale and reach. Digital storefronts removed geographic constraints, while paid media unlocked predictable traffic. Growth became measurable, optimisable, and repeatable. However, interaction remained largely one-directional, brands pushed offers, consumers clicked. Success was driven by acquisition volume rather than relationship depth.

As competition intensified, brands shifted focus from traffic to experience. Apps replaced websites, omnichannel journeys emerged, personalization became a differentiator, and fast delivery turned into a baseline expectation. While this phase improved engagement and convenience, it also introduced fragmentation. Experience was layered on top of disconnected systems, making it difficult to unify data, intelligence, and execution. Growth scaled – but often at the cost of margin clarity and operational coherence.

Commerce 4.0 represents a structural shift, not a feature upgrade. It is defined by AI-led intent understanding, real-time orchestration, and unified commerce systems. Brands no longer react to past behaviour – they anticipate intent. Decisions are no longer batch-based; they are continuous. Experience, operations, and profitability are optimised together rather than in isolation.

The move from clicks to conversations is not about chat interfaces or conversational UI alone. It is about creating a continuous, data-driven dialogue between the brand and the consumer – spanning discovery, consideration, purchase, fulfilment, service, and retention. Every interaction informs the next. Every signal improves the system.

In this model, commerce becomes adaptive. Pricing, content, fulfilment options, and engagement pathways adjust dynamically based on context, behaviour, and business outcomes. Brands stop “running campaigns” and start orchestrating relationships.

Commerce 4.0 is where growth compounds – not because brands do more, but because systems learn faster, decisions improve continuously, and conversations replace transactions as the core unit of value.

In Commerce 4.0, conversations are often misunderstood as chat interfaces or automated customer replies. In reality, conversations are systemic, not conversational UI. They are the invisible intelligence layer that allows brands to listen, interpret, respond, and learn – continuously and at scale.

Conversations in Commerce 4.0 are contextual. Every interaction is driven by real-time intent signals – what the customer is browsing, where they came from, their price sensitivity, inventory availability, location, and historical behaviour. Decisions are no longer static or rule-based; they adapt to context as it unfolds.

They are continuous, not confined to a single moment or channel. The dialogue between brand and consumer spans discovery, consideration, checkout, fulfilment, support, and repeat purchase. Each interaction builds on the last, ensuring continuity rather than fragmentation across touchpoints.

They are intelligent, powered by clean data, AI models, and feedback loops rather than manual segmentation. Systems learn from outcomes – what converted, what failed, what was returned, what was retained—and refine future decisions automatically. Intelligence compounds over time.

Most importantly, they are outcome-led. Conversations are not designed to increase engagement metrics in isolation. They are engineered to improve hard business outcomes – conversion rates, lifetime value, repeat purchase frequency, and margin efficiency.

In practice, this shifts how commerce operates:

This is the point where traditional funnels break down.

Funnels assume linear movement – awareness to conversion. Commerce 4.0 replaces funnels with feedback loops, where every outcome informs the next decision. Growth becomes adaptive, not reactive.

In this model, conversations are not something brands “run.” They are something the system learns, refines, and scales continuously. That is the operational difference between digital commerce as a channel and Commerce 4.0 as a growth system.

Traditional commerce has long relied on funnels – a linear construct where brands acquire traffic, push for conversion, and then treat retention as a downstream activity. Funnels assume customer journeys are predictable, intent is static, and success is defined at the point of transaction.

Commerce 4.0 challenges all three assumptions.

Instead of linear funnels, modern commerce leaders are shifting to feedback loops, where growth is driven by continuous intelligence rather than one-time optimisation. The operating logic evolves from acquire → convert → retain to intent → context → conversation → conversion → continuity.

In this model, every interaction – before and after purchase – feeds back into the system. Conversion is no longer the finish line; it becomes an input that shapes pricing, assortment, fulfilment, engagement, and re-acquisition strategies.

Funnels assume linearity.

Feedback loops assume intelligence.

Commerce 4.0 cannot be applied uniformly across regions. While India and the GCC are both digitally mature, the drivers of growth, friction points, and operating realities differ fundamentally. Brands that fail to localise their commerce strategy often scale volume – but not value.

India: Scale, Speed, and Sensitivity

India’s commerce ecosystem is defined by massive scale combined with structural complexity. Demand is deep and expanding, but execution readiness determines success.

Key characteristics include:

According to RedSeer, over 35% of quick-commerce dark stores are now located outside metros, and this share continues to rise rapidly.

India’s challenge is not demand generation. It is the ability to:

In India, Commerce 4.0 succeeds when intelligence replaces brute-force growth.

GCC markets operate on a different growth logic – one driven by value, experience, and decision velocity rather than sheer volume.

Defining traits include:

According to Statista, BNPL adoption in the GCC is growing at over 25% CAGR, driven by younger demographics and fintech maturity.

For GCC brands, the priority is not scale – it is:

GCC brands demand speed, trust, and precision, not experimentation.

Commerce 4.0 is a framework, not a template. In India, it optimises for scale without chaos. In the GCC, it delivers experience without inefficiency.

Brands that understand this distinction move faster – not because they execute more, but because they execute right. This regional intelligence is what separates generic digital commerce execution from market-aware growth systems.

Commerce 4.0 is not a technology upgrade – it is an economic operating model. Its real value lies in how it rewires the fundamental profit levers of a commerce business, moving growth from volume-led to value-led.

At its core, Commerce 4.0 impacts five critical economic drivers:

According to McKinsey, organizations that successfully align data, experience, and operations can unlock a 5–10% uplift in EBITA, primarily by reducing leakage caused by fragmented systems and poor decision-making

In practical terms, Commerce 4.0 shifts the conversation from:

This is why Commerce 4.0 resonates not just with growth teams – but with CFOs, COOs, and boards focused on sustainable value creation.

While Commerce 4.0 is inevitable, success is not. Most brands will struggle – not because they lack ambition, but because they approach Commerce 4.0 as a tool upgrade, not an operating shift.

The failure patterns are already visible across markets:

Commerce 4.0 exposes these cracks because it is unforgiving. It rewards systems thinking, decision ownership, and execution discipline.

This is why Commerce 4.0 does not work with vendors. It requires growth/operating partners – teams that take accountability across strategy, technology, conversion, and profitability, and are measured not by activity, but by outcomes. In the next phase of digital commerce, the differentiator will not be who adopts Commerce 4.0 first – but who is structurally ready to operate it.

At GreenHonchos (GH), Commerce 4.0 is not a channel strategy or a technology upgrade. It is an operating framework that redefines how brands grow, decide, and compound value in an always-on, AI-enabled world.

We define Commerce 4.0 through five interconnected pillars. Each pillar solves a structural failure of modern commerce and together, they form a self-reinforcing growth system.

Understanding why a customer acts – not just what they click…

Most commerce systems are built around observable actions: page views, clicks, carts, and conversions. Commerce 4.0 begins one layer deeper – by decoding intent.

Intent intelligence combines:

This allows brands to distinguish browsers from buyers, deal-seekers from loyalists, and explorers from churn risks.

Without intent intelligence, personalization remains cosmetic – surface-level changes that look tailored but do not materially impact conversion, retention, or margin.

In India, intent intelligence helps brands manage price sensitivity, COD risk, and discovery overload. In the GCC, it enables premium personalization, high-AOV confidence building, and service-led differentiation.

Intent is the foundation. Everything else depends on it.

One connected view of customers, inventory, performance, and fulfilment…

Most brands operate with fragmented stacks:

Each system optimises locally. Decisions are made globally – often without alignment.

Commerce 4.0 requires a unified commerce stack – not a single platform, but a connected intelligence layer across systems. When inventory, demand, pricing, fulfilment, and experience are disconnected, decisions become delayed, reactive, and inconsistent.

This fragmentation is not a minor issue. According to Gartner, over 70% of digital transformation initiatives fail due to poor integration and data silos, not technology limitations

In practice:

Unified stacks turn data into decisions – not dashboards.

CRO as a system, not an experiment…

In Commerce 3.0, CRO was treated as a set of tests – isolated A/B experiments, UI tweaks, or campaign-led optimizations. Commerce 4.0 reframes CRO as conversion engineering.

This includes:

Conversion engineering recognises that conversion is not owned by marketing alone. It sits at the intersection of product, tech, operations, payments, and CX.

In India and the GCC, the impact is disproportionate. At enterprise scale, even a 0.5–1% uplift in CVR can unlock multi-crore revenue gains – often with no additional acquisition spend.

Conversion is not about persuasion anymore.

It is about removing friction from intent.

AI augments decisions – it doesn’t replace teams…

Commerce 4.0 does not use AI as a bolt-on feature. It embeds AI as an orchestration layer – connecting intent, systems, and execution in real time.

AI-led orchestration enables:

Importantly, AI in Commerce 4.0 does not eliminate human judgment. It augments decision- making, allowing teams to operate faster, smarter, and at scale.

According to PwC, organisations using AI-driven decisioning layered over clean, connected data see up to 30% improvement in marketing ROI. In fast-moving markets like India and experience-driven markets like the GCC, AI becomes the only viable way to operate at the speed consumers now expect.

Embedding margin discipline into the growth system…

The final pillar addresses the most critical shift in modern commerce: growth is no longer defined by revenue alone.

Commerce 4.0 treats profitability as a design principle, not a post-facto correction.

This includes:

In both India and the GCC, brands that scale fastest without profitability controls often face margin erosion, operational stress, and growth reversals.

Commerce 4.0 embeds profitability into:

Sustainable scale is engineered – not hoped for. Individually, each pillar creates incremental value. Together, they form a self-reinforcing growth system:

Intent informs orchestration.

Orchestration drives conversion.

Conversion improves profitability.

Profitability funds smarter growth.

Growth generates richer intent signals.

This is the Commerce 4.0 loop.

And this is where GreenHonchos operates – not as a service provider, but as a growth partner for brands navigating the next phase of digital commerce across India and the GCC.

Commerce 4.0 does not require multi-year transformation roadmaps to begin delivering value. In fact, the brands that win are those that can diagnose, align, and execute within the first 90 days. This initial window reveals whether Commerce 4.0 is an aspiration – or an operational reality.

Leaders should start by asking a few uncomfortable but decisive questions:

This 90-day lens separates intent from capability. Strategy decks, vision documents, and transformation narratives have limited value if execution velocity remains slow. In Commerce 4.0, execution speed is a strategy.

The brands that emerge as leaders are not those with the most ambitious roadmaps – but those that can align data, systems, and teams fast enough to convert insight into action within weeks, not quarters.

Commerce 4.0 readiness is not a destination. It is a test of how quickly a brand can move from knowing to doing.

Commerce 4.0 fundamentally reframes how leaders must think about digital commerce. It is no longer a collection of channels – website, app, marketplace, store, social – each optimised in isolation. Instead, commerce becomes a growth system, where every interaction feeds intelligence, improves decisions, and compounds value over time.

In a growth system, acquisition is informed by intent, experience is shaped by context, conversion is engineered – not hoped for – and post-purchase signals continuously refine pricing, assortment, retention, and future demand. Channels do not compete; they collaborate. Data does not sit in silos; it circulates. Performance is not measured episodically; it is optimised continuously.

This is why traffic alone no longer defines success. In India and the GCC alike, brands already have access to demand. What differentiates leaders is their ability to interpret intent, orchestrate responses in real time, and turn every interaction into a learning loop that improves the next one. Intelligence – not volume – becomes the primary growth lever.

At GreenHonchos, we view commerce not as a frontend activity but as an operating system for growth. This is the shift we track, decode, and enable across India and the GCC – helping global retail brands move from fragmented channels to unified systems, from clicks to conversations, and from short-term growth to sustainable, compounding scale.

In the rapidly evolving retail landscape of the Gulf Coopera...

In the evolving world of modern retail, success isn’t just...

In today’s global eCommerce ecosystem, marketplaces have b...

In the fast-paced digital world, time is everything, especia...

As Henry Ford wisely said, “The only real mistake is the ...

For many years, July was often considered a slow month for r...

With the overall increase in global retail sales figures, th...

In the...

In the...

The Indian eCommerce industry is transforming at a faster pa...

It’s been a while since Meta introduced its contender to T...

Marketing your brand at Amazon can exponentially boost your ...

The pandemic has brought about a lot of changes and ada...

There is no denying the fact that marketplaces have bee...

The post-pandemic world has made brands realise the importan...

We are living in a digital age where every brand is coming a...

Digital media accounted for 64.4% of global ad sp...

Marketers since generations have banked heavily on the ...

Social Media has grown rapidly in the past couple of years. ...

The first step towards building a successful business i...

Want to take your eCommerce business to the next level? We help businesses make the most at every stage - from product conceptualization to achieving the maximum optimization & ROI on business operations.

B-24, Sector 3, Noida, GB Nagar,

Uttar Pradesh 201301, India

Mazaya Business Avenue, Tower AA1,

FZCO, Office #18, 36th floor, JLT, Dubai, UAE

1st Floor, Plot-183, Indiranagar Stage 2,

Bengaluru, Karnataka,

560038, India