The Phygital Approach: Reinventing the customer experience in the eCommerce Industry

The pandemic has brought about a lot of changes and adaptations which have efficaciously changed…

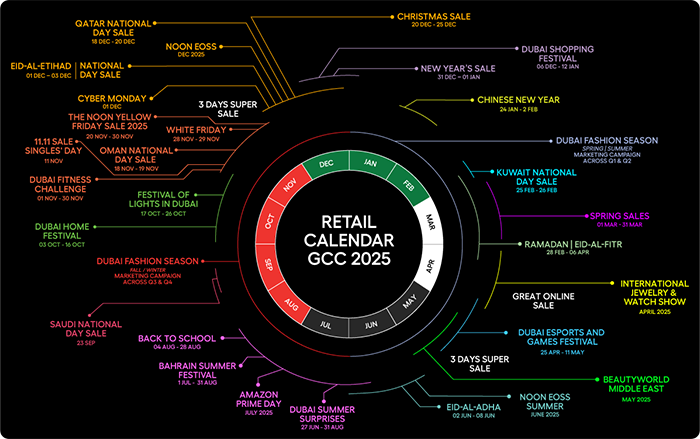

In the rapidly evolving retail landscape of the Gulf Cooperation Council (GCC) market, success is increasingly defined by presence, precision, and momentum. Every year presents a series of high-impact retail events – regional sales festivals, global online shopping moments, excitement- driven retail peaks – that offer brands strategic windows to boost growth, deepen engagement and merge digital commerce with physical. For forward-looking retail brands, these are no longer just “occasions” but critical growth levers.

The GCC is moving fast. The region’s eCommerce market alone was valued at USD 507.2 billion in 2024 and is projected to surge to over USD 2,020.6 billion by 2033, at a CAGR of 15.3%.

On the retail infrastructure and consumption side, the GCC has seen retail-space expansion, luxury retail growth, and a young, digital-first population fueling demand.

In this context, identifying and activating around key event windows allows brands to tap into heightened consumer readiness, cross-border shopper flows, and high disposable incomes. These moments are far more than short-term spikes—they are strategic platforms to scale digitally and physically.

Here are some key dates/periods worth aligning with (exact dates may vary by year):

The crown jewel of GCC retail, the Dubai Shopping Festival transforms the city into a global shopping hub every winter. From mega mall promotions to online flash deals and experiential pop-ups, it drives millions in cross-border spending. For brands, it’s the perfect moment to launch new collections, attract tourists, and maximize omnichannel visibility.

While not native to the Gulf, Chinese New Year celebrations in Dubai and Bahrain attract a strong expat and tourist community. Luxury brands, jewelry, and gifting categories thrive during this time through targeted promotions that cater to high-spending travelers and Asian consumers visiting GCC retail hubs.

Twice a year, Dubai’s fashion ecosystem unites under this event, spotlighting regional designers and international brands. It’s a major opportunity for apparel, accessories, and beauty brands to showcase trend-led collections, partner with influencers, and build cross-market visibility across the GCC fashion-conscious consumer base.

Celebrated with patriotic spirit and luxury spending, Kuwait National Day sparks high retail engagement. From premium electronics to fashion and gifting, local retailers roll out attractive offers, while online platforms capitalize on heightened national sentiment and digital shopping enthusiasm.

One of the most significant retail periods in the GCC, Ramadan is defined by high consumer engagement in gifting, food, fashion, and home décor. Eid celebrations mark a surge in last- minute shopping, with 30–40% spikes in fashion and gifting categories. Retailers use storytelling-led campaigns, ethical branding, and midnight delivery options to win consumer trust.

Run by Dubai Economy, this annual digital-first retail event encourages shoppers to go fully online for unbeatable deals. Ideal for D2C and omnichannel brands, it accelerates traffic and conversions through flash sales and app-based discounts, bridging offline presence with eCommerce precision.

A high-energy platform merging gaming, entertainment, and retail, this event attracts Gen Z audiences and digital-first consumers. Tech, apparel, and lifestyle brands can leverage collaborations, influencer tie-ins, and limited-edition drops to ride the eSports trend wave across digital touchpoints.

Held several times a year, Dubai’s 3-Day Super Sale offers steep discounts across major malls and eCommerce platforms. The event records 20–30% higher footfall and online traffic, making it a golden opportunity for brands to clear inventory, test pricing elasticity, and boost volume sales.

The region’s largest beauty and fragrance trade event, Beautyworld attracts top global and local brands. It’s where emerging beauty D2C labels find international distributors, launch new product lines, and gain visibility. Luxury, innovation, and retail-tech collaborations take center stage here.

Noon’s biannual EOSS is a retail powerhouse, driving massive traffic across fashion, electronics, and home categories. For brands, this is the best time to manage inventory transitions, boost marketplace visibility, and run conversion-focused ads with high CTR and ROAS potential.

Known as the ‘Festival of Sacrifice’, Eid al-Adha sparks major retail activity in apparel, luxury, and gifting. Families indulge in celebratory shopping, leading to spikes in premium purchases. Brands often align storytelling around gratitude and family values to strengthen emotional connections.

A retail and entertainment festival designed to counter summer slowdowns, DSS drives footfall through in-mall activations, digital contests, and exclusive offers. eCommerce brands integrate campaigns with in-store experiences, capturing both tourists and residents looking for summer indulgence.

Amazon’s global mega event now holds strong traction in the GCC, especially among Prime members in UAE and KSA. D2C brands leverage Amazon Ads, lightning deals, and influencer- led content to boost discoverability and acquire new-to-brand customers at scale.

One of Saudi Arabia’s biggest national holidays, this day drives record-breaking online and in- store sales. Under Vision 2030, Saudi shoppers have become more digital-savvy, with brands focusing on limited-time drops, localized content, and region-specific loyalty offers.

Back-to-school season drives strong demand in stationery, fashion, electronics, and personal care. Retailers in GCC create omnichannel campaigns targeting parents and students through convenience-driven offers, tech bundles, and multi-channel visibility.

This event brings together interior brands, décor retailers, and online stores offering home solutions. With consumers investing more in home aesthetics post-pandemic, D2C brands in furniture, textiles, and lifestyle segments capitalize through visual storytelling and AR-based shopping tools.

White Friday (regional Black Friday) and Singles’ Day (11.11) are now integral to GCC retail, accounting for 25–30% of Q4 sales. Marketplaces like Noon, Namshi, and Amazon dominate this window, offering deep discounts, fast delivery, and cross-border deals—making it a must- win digital event.

Following White Friday, Cyber Monday is a digital-first continuation of the sales wave. Tech, lifestyle, and fashion brands can leverage paid media, remarketing, and urgency-driven offers to convert browsing momentum into final sales.

An initiative by the Dubai Government, this 30-day movement promotes wellness across the city. Sportswear, activewear, and health brands benefit from collaborations, challenges, and community-led campaigns, blending lifestyle with purpose-driven marketing.

The holiday season marks the year’s grand finale, merging global festive energy with GCC’s retail dynamism. Brands focus on gifting, fragrance, fashion, and lifestyle, running storytelling- led campaigns and premium bundles to capture end-of-year spending.

The retail calendar in the GCC is no longer a passive timeline of sales events—it’s a strategic architecture for brand growth. For brands that anticipate, align and execute across these windows, the combination of digital presence + physical experience can unlock lasting customer relationships, deeper loyalty and meaningful scale. Growth in the Gulf region is not just seasonal—it becomes systematic.

At GreenHonchos, we’ve seen how leading eRetail brands use these high-impact periods to test new product lines, scale campaigns with performance precision, and build stronger communities around their brand story. These moments are no longer short-term opportunities; they’re long- term growth multipliers. Because in the new era of Gulf retail, every event is an opportunity to connect, convert, and create enduring brand value.

In the rapidly evolving retail landscape of the Gulf Coopera...

In the evolving world of modern retail, success isn’t just...

In today’s global eCommerce ecosystem, marketplaces have b...

In the fast-paced digital world, time is everything, especia...

As Henry Ford wisely said, “The only real mistake is the ...

For many years, July was often considered a slow month for r...

With the overall increase in global retail sales figures, th...

In the...

In the...

The Indian eCommerce industry is transforming at a faster pa...

It’s been a while since Meta introduced its contender to T...

Marketing your brand at Amazon can exponentially boost your ...

The pandemic has brought about a lot of changes and ada...

There is no denying the fact that marketplaces have bee...

The post-pandemic world has made brands realise the importan...

We are living in a digital age where every brand is coming a...

Digital media accounted for 64.4% of global ad sp...

Marketers since generations have banked heavily on the ...

Social Media has grown rapidly in the past couple of years. ...

The first step towards building a successful business i...

Want to take your eCommerce business to the next level? We help businesses make the most at every stage - from product conceptualization to achieving the maximum optimization & ROI on business operations.

B-24, Sector 3, Noida, GB Nagar,

Uttar Pradesh 201301, India

Mazaya Business Avenue, Tower AA1,

FZCO, Office #18, 36th floor, JLT, Dubai, UAE

1st Floor, Plot-183, Indiranagar Stage 2,

Bengaluru, Karnataka,

560038, India